The new contribution system

On Wednesday 27th the new system was approved, which will come into force on 1 January 2023 and will end in 2032. The new contribution system for the self-employed will make it compulsory to pay contributions based on actual income.

Net income of the self-employed

On 1 January, the self-employed will have to notify the Social Security via the ImportaSS portal, the forecast of the net income that they are going to obtain in the exercise of all their economic, business or professional activities.

The calculation of the net income will be carried out by deducting from the income all the expenses necessary to obtain the income and on that amount.

A deduction for general expenses is established:

a) 7% for the self-employed,

b) 3% for the corporate self-employed.

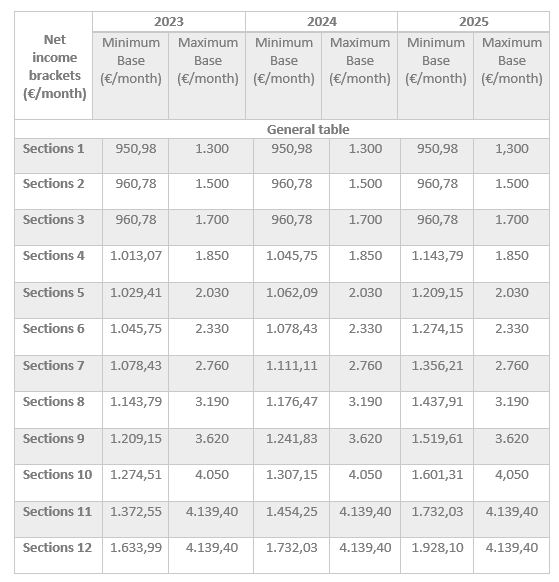

New contribution bases

Depending on the income forecast, the self-employed must choose a contribution base between the minimum contribution base corresponding to their income bracket according to the general table and the maximum contribution base established for each year in the LPG (*).

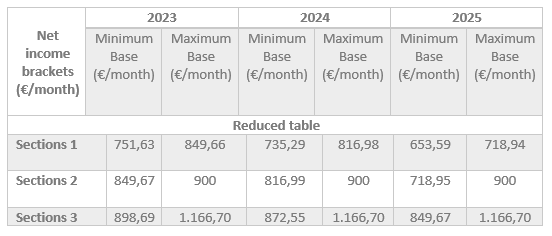

If the income forecast is lower than the minimum contribution base established for the RGSS, the reduced table also established annually in the LPG is applied. However, the minimum contribution base for family members of self-employed workers included in the RETA(*) and self-employed companies may not be lower than that established for contribution group 7 in the RGSS(*).

If you have any queries regarding this new contribution system, please do not hesitate to contact us by telephone at Isabel Torre Carazo or by e-mail at itc@btsasociados.com, we will be delighted to help you.

(*) LPG: Ley presupuestos generales (*) RETA: Special Scheme for Workers (*) RGSS: General Social Security Scheme (*) RGSS: General Social Security Scheme